Proof-of-work vs Proof-of-stake the battle of consensus mechanisms for the future of cryptocurrency mining nodes

by Natasha Kingsley, Design Enterprise Studio Member, March 2022

Nowadays in this digital era, it is beyond reasonable doubt that most people know what a cryptocurrency is. What they don’t necessarily know is how to start mining it. This article will dive into the inner workings of each mechanism and explain why each one could be a potential contender.

My name is Natasha Kingsley, I am a sound designer and videographer with a current interest in cryptocurrencies. The power play between the predominant and alternative mechanisms for mining blockchain technologies has recently been on my radar; sparking my interest in answering the question: which mechanism will gain command as the predominant consensus in the future?

Wait, how do you actually mine a crypto asset?

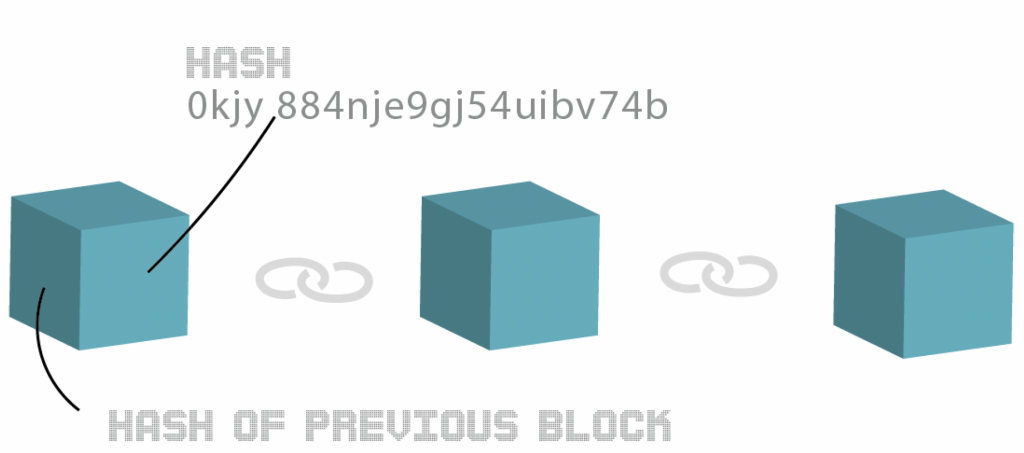

Well, to understand the way the consensus mechanisms work, you first must understand how to mine cryptocurrency in the first place. It all starts with a blockchain. You can think of a blockchain as a list of transactions recorded in chunks called blocks. Inside each block contains “hash” components that are much like digital fingerprints. They generate codes that are connected to the hash of the previous block and the current block. If any part of the block is tampered with it will inevitably change the hash of the block, making it no longer valid and it will be rejected. This makes this system very secure and significantly difficult for a cyber-attack.

The blocks are also decentralised, meaning they aren’t governed by a central bank or public authority. Instead, they are managed by a global network of miners through a peer-to-peer node network. Where they record and verify the blocks of transactions and are then rewarded with newly mined cryptocurrency. However secure this blockchain technology may seem, even this is not enough to prevent tampering.

Introducing: the predominant consensus mechanism, Proof-of-Work

To diminish tampering, blockchains have a consensus mechanism called Proof-of-Work. The Proof-of-Work algorithm works by having all nodes solve a cryptographic puzzle, the puzzle is solved by miners and the first one to find the solution gets the miner reward. Here lies the first problem with this system, and where the high energy expenditure comes in. A recent paper has found that the top 6 Proof-of-Work crypto assets systems consume approximately as much energy as the entire country of Belgium in 2016.

Another dark side to Proof-of-Work is invoking competition between miners. As the ‘winner takes all’ attitude spurs the build of larger mining farms to increase the chances of cracking the puzzle.

Alternatively, you can create a mining pool with thousands of miners all coordinated to one block to increase the likelihood of obtaining the reward. This is where the 51% attack could come into play. If one of the largest mining pools were able to obtain 51% hashing power, it would inevitably result in the centralisation of the system and would encourage validating fraudulent blocks. Big security problem.

To make things worse, it gets more complicated when you try and find an accurate carbon footprint of these crypto assets. Although energy consumption alone isn’t enough to produce a carbon footprint. Each power source, hydro, wind, and coal, emits a different amount of carbon to produce the amount of energy. To calculate an accurate carbon footprint, you’d need to find out where each miner gets their energy from. It’s estimated that Bitcoins Carbon emissions comes close to the whole country of New Zealand, coming in at a whopping 37 megatons of carbon dioxide each year. If only there were a greener alternative…

Introducing: the opposing consensus mechanism, Proof-of-Stake

Intending to counter this problem, in 2012, another consensus mechanism called Proof-of-Skate was proposed. Displaying a promising potential for a more sustainable future for blockchain technologies, Proof-of-Stake uses an algorithm that allocates blocks based on distribution of wealth instead of computational power. Meaning there is no need for miners to accumulate masses of specialised equipment for setting up Proof-of-Work nodes to validate blocks. Although it reins in the energy consumption by a significant amount, not everyone is convinced. Here’s why:

Proof-of-Stake vs Proof-of-Work: By solving one problem, you create another

So, the language varies from each consensus mechanism. Where Proof-of-Work uses miners and mining, Proof-of-Stake uses validators and minting or forging. Proof-of-Stake works by validators initially depositing a certain amount of coins into the network as stake.

Operating much like a security deposit, the size of the stake determines the chances of the validator being chosen to mint the next block. This means that instead of sending the block out to everyone, only one validator gets the block. This is where the problem arises, and miners aren’t eager to convert over.

Not only does it illuminate everyone getting a chance at validating the next block, but it also brings forward a question. Does Proof-of-Stake favour the wealthy? The short answer is, surprisingly, no. The algorithm does factor in how much wealth you have put in the network but also takes other variables into account to make the selection process as fair as possible.

Okay, so what about the 51% attack?

Well, much like the Proof-of-work system it is possible for a validator to obtain 51% of the hashing power, centralising the system and start approving fraudulent blocks. On the other hand, to do so in the Proof-of-Stake system is significantly more expensive than to do it in the Proof-of-Work system because of the opportunity costs.

It would also deter attacking the network if one validator holds 51% of the power in the Proof-of-Stake system instead of one, or multiple miners holding 51% of the power in Proof-of-Work. Overall, there are multiple reasons for and against either consensus mechanism to dominate.

So, who is currently winning the battle and who will win the war?

In a nutshell, Proof-of-Stake brings additional risks when compared to Proof-of-work and needs further research to fully understand the limitations. Although Proof-of-Stake is a definitely more sustainable option, at the moment, Proof-of-Work is currently holding down the fort as the current winner of the battle.

However, since Proof-of-Stake was invented, a few cryptocurrencies such as Ethereum have pledged to change their consensus from Proof-of-Work to Proof-of-Stake to hopefully promote others to follow suit.

On the other hand, virtually all Bitcoin miners are against converting over. Furthermore, the fact that Bitcoin doesn’t have a central body means all minors will have to agree on the voluntary conversion, and that won’t happen overnight.

Going into a more eco-aware age, I envision an era where we will start to see more Proof-of-Stake consensus mechanisms implemented within blockchain technologies. In my opinion, Proof-of-Stake will eventually win the war, although the battle between Proof-of-Work and Proof-or-Stake is still ongoing and will be for the foreseeable future.